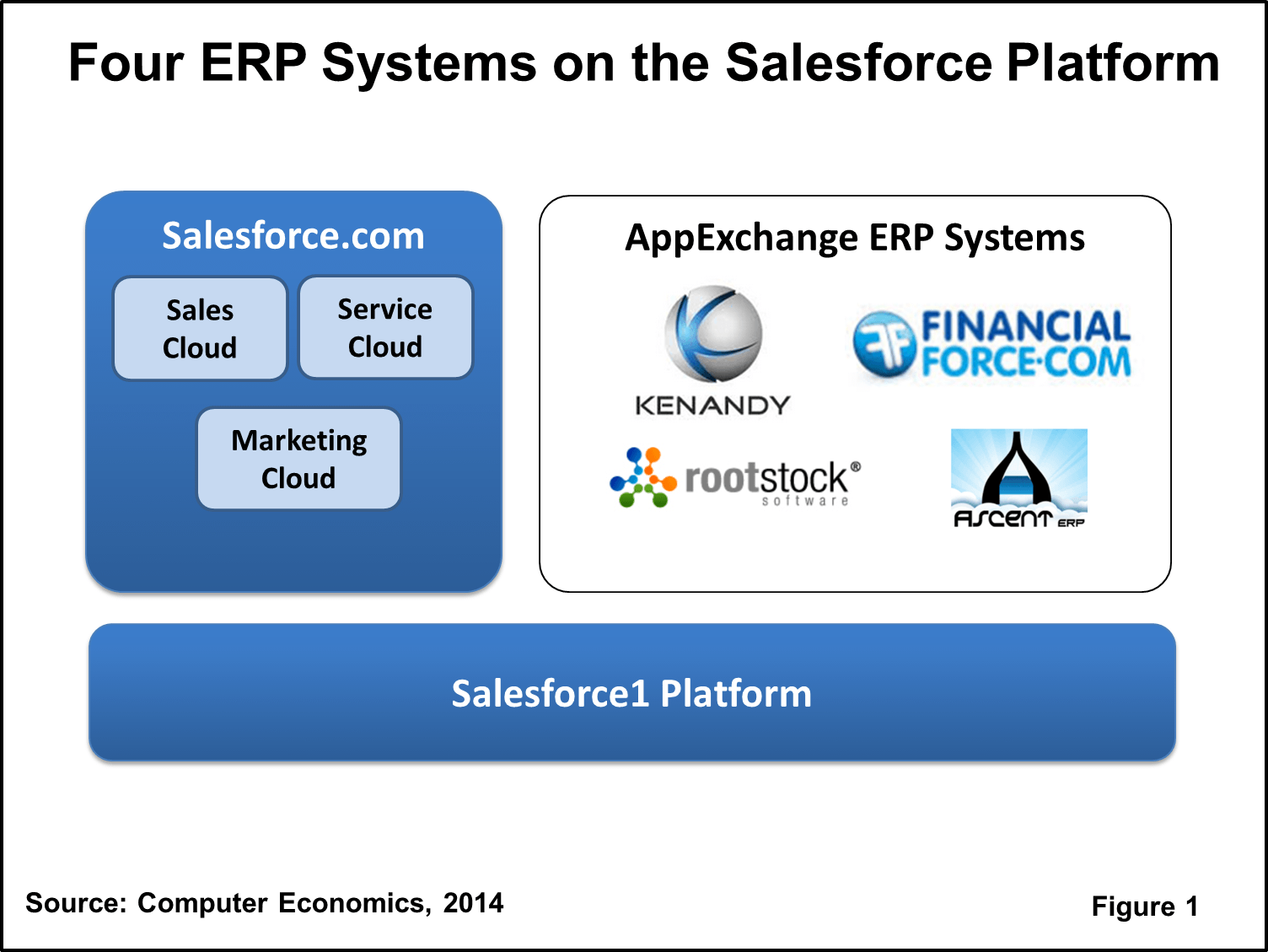

Today, there is no manufacturing cloud ERP provider with the size or scale of Salesforce.com or Workday. Contrary to popular belief, this is not because the opportunity is small. Manufacturing still comprises a large percentage of US companies and is an enormous opportunity for cloud ERP. This post outlines the challenges that cloud ERP providers face and what it will take for them to dominate the market for manufacturing systems.