At its annual user conference in May, cloud ERP provider NetSuite promoted enhanced functionality for manufacturing companies.

If NetSuite is going to continue its growth, reported at 28% last year in its core business, it really has no choice but to pursue manufacturing customers. Manufacturers are the largest market for ERP systems and therefore an attractive target for NetSuite’s development efforts. Although manufacturers have been slower to embrace cloud computing than many other sectors have, the situation is rapidly changing.

In our ERP vendor selection services, we find manufacturing companies increasingly open to cloud ERP. Sometimes, in fact, they only want to look at cloud solutions. In other words, NetSuite is at the right place at the right time. At the same time, there are a number of decision points for NetSuite as it continues to build out its manufacturing functionality.

Balancing New Functionality with Need for Simplicity

To more fully address the needs of manufacturing, NetSuite continues to build out its core functionality, with basic must-have features such as available to promise (ATP) calculations, routings, production orders, and standard costing. In some of the breakout sessions, there were indications of that NetSuite is also exploring functionality that goes well beyond the basics: for example, supply chain management (SCM) and demand-driven MRP (DDMRP).

This leads to the first decision point that NetSuite will need to address: filling out gaps in manufacturing functionality while not over-engineering the system. Oracle and SAP are famous for having manufacturing systems that are feature-rich, requiring significant time and effort from new customers to decide which features to configure and to implement them. Part of the attraction of NetSuite is its relative simplicity and ease of implementation. If NetSuite wants to remain an attractive option for the likes of small and midsize manufacturers, or small divisions of large companies, it will be wise to pick and choose where to build out the sophistication of the product.

For example, the availability of multi-books accounting is a good move, as it has widespread applicability to both small and large companies in the manufacturing industries as well as other sectors. But does DDMRP fall into the same category? Moreover, how much SCM functionality do prospects expect from NetSuite, and where does it make sense to partner with best-of-breed specialists, who can better bridge a variety of SCM data sources?

Netsuite’s recent success with manufacturers such as Qualcomm, Memjet (discussed below), and others give it real-world customers to validate its product roadmap. It will do well to prioritize new development efforts to the areas where those customers deem most needed. NetSuite may choose, ultimately, to fully move up-market, to become the manufacturing cloud equivalent of SAP or Oracle. But if it does so, there are already a number of other cloud ERP providers, such as Plex, Rootstock, Kenandy, Acumatica, and Keyed-In Solutions, that will be ready to take NetSuite’s place serving small and midsize manufacturers.

NetSuite’s PLM/PDM Strategy Needs Openness

NetSuite also announced a new alliance with Autodesk to integrate its PLM 360 offering for product lifecycle management with NetSuite’s ERP. This is in addition to NetSuite’s existing partnership with Arena Solutions.

PLM systems manage the entire life-cycle of product development, from ideation and requirements gathering, through design and development, to release to manufacturing, service, engineering change, and retirement. PLM systems take an engineering view of the product and are generally under the domain of the client’s product engineering function. PLM systems generally include product data management (PDM) systems as a subset, to manage all of the product data, such as drawings, specifications, and documentation, which form the definitions of the company’s products.

Over the past 20+ years, the integration of PLM and PDM systems with ERP has been a difficult subject. In organizations where engineering and manufacturing work well together, basic roles and responsibilities can be defined and proper integration of data can be accomplished. In organizations where such cross-functional processes are weak, PLM/PDM and ERP often form separate silos.

Autodesk’s PLM 360 shows very well, and the story about its cloud deployment matches well with NetSuite. However, the majority of manufacturers would do well simply to establish simple integration between their engineering bills of material (within their PLM/PDM systems) and their manufacturing bills of material (within their ERP systems). Making engineering documentation within the PLM/PDM system available to manufacturing ERP users is also highly desired. Furthermore, there are few engineering organizations that have not already standardized on a PLM/PDM system (e.g PTC’s Windchill, Solidworks, and others), and they will seldom be willing to migrate to Autodesk just because the company is implementing NetSuite’s ERP.

This is another decision point that NetSuite must address: will it offer standard integration to a variety of PLM/PDM systems, or will its answer to engineering integration be, “Go with Autodesk or Arena?” NetSuite executives insist that their strategy is to partner with Arena and Autodesk while at the same time maintaining openness to integration with other PLM/PDM solutions.

Case Studies Encouraging

To validate its progress in the manufacturing sector, NetSuite reported on several case studies.

- At the large end of the spectrum there is Qualcomm, the $19 billion manufacturer of semiconductors and other communications products. Although Qualcomm has Oracle E-Business Suite running throughout much of its operations worldwide, in 2011 CIO Norm Fjeldheim chose NetSuite for use in smaller divisions, based on the need for implementation speed and agility. As part of that strategy, Qualcomm has now gone live with NetSuite in a newly launched division in Mexico. This is a nice “existence proof” for a two-tier ERP strategy in a very large company.

- At the smaller end of the spectrum there is Memjet, a manufacturer of high-speed color printer engines. Martin Hambalek, the IT director at Memjet, did a short on-stage interview during the first keynote of the conference. Although the company has just 350 employees, it has engineering and manufacturing operations in five countries. Unlike Qualcomm, Memjet runs NetSuite as its only ERP system worldwide, showing NetSuite’s capabilities for multinational businesses. Notably, Memjet is also a customer of Autodesk for its PLM 360 system, mentioned earlier. Interestingly, Hambalek is the only full-time IT employee at Memjet: evidence that a full or largely cloud-based IT infrastructure requires many fewer IT resources to maintain.

Customer stories are the best way to communicate success, and these two NetSuite customers substantiate NetSuite’s progress.

Rethinking the Services and Support Strategy

As much as ERP functionality is important to manufacturers, there is another element of success that is even more important: the quality of a vendor’s services and support. Nevertheless, during the keynotes, apart from an announcement of Capgemini as a new partner, there were no announcements about NetSuite’s professional services.

More ERP implementations fail due to problems with implementation services than because of gaps in functionality. Functional gaps can be identified during the selection process: but problems with the vendor’s implementation services are more difficult to discern before the deal is signed. Furthermore, functional gaps can often be remedied through procedural workarounds. But once the implementation is underway, failures in implementation services are difficult to remedy. Sometimes, such failures wind up in litigation.

In this regard, NetSuite’s rapid growth has a downside: it stretches and strains the ability of NetSuite’s professional services group to spend adequate time and attention on its customers’ implementation success. One solution is to build a strong partner channel of VARs, resellers, and implementation service providers to complement or even take over responsibility for post-sales service and support.

During the analyst press conference, CEO Zach Nelson indicated that NetSuite is building its partner channel. But how does NetSuite decide what work should go to its implementation partners and what part should be retained for NetSuite’s own professional services group? Nelson’s answer reflected a traditional view that whoever brings the sales lead to NetSuite should get the services. In other words, if a lead comes through NetSuite’s own sales team, NetSuite should get the services work. If the lead comes through a partner, the partner should get the services.

NetSuite should rethink this strategy. The party that happens to find the prospect may not be the best party to deliver the services. In fact, NetSuite may be better served by passing off implementation services to local partners that are willing to spend more time with the customer on-site than NetSuite’s own professional services group may be able to provide.

At the end of his answer, Nelson indicated that he would actually prefer that NetSuite not be in the professional services business. If so, this is good news. Let NetSuite focus on developing and delivering cloud ERP, and let a well-developed partner channel compete to provide hands-on implementation services. What professional services NetSuite does provide would be better focused on providing support to those partners.

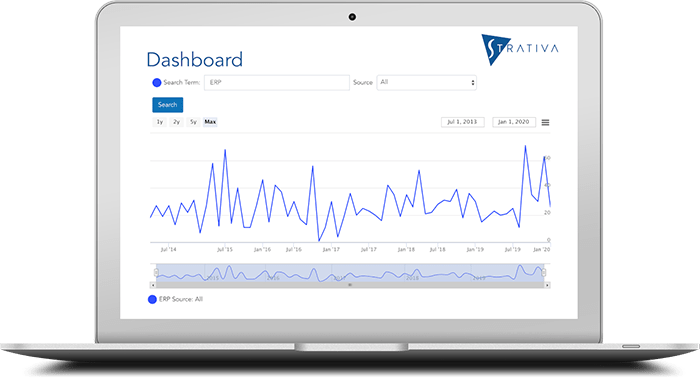

This post is an analysis of news presented at NetSuite’s recent Suiteworld conference. A video interview with Strativa President, Frank Scavo on this subject is also is available.