We were at Infor’s headquarters in New York City recently for Infor’s Innovation Summit, its annual event for industry analysts. It’s a good two day briefing, packed with a lot of information on Infor’s broad portfolio of products and its many new initiatives, along with access to all of its top executives.

One of our goals was to see what kind of progress Infor has been making on its CloudSuite program, and especially its UpgradeX initiative, which is aimed at upgrading Infor’s existing customer base to current versions deployed in the cloud. In our ERP selection consulting services, we often see Infor as the incumbent provider, so knowing the details of these offerings is important in understanding options for these clients going forward.

In summary, Infor’s CloudSuite and UpgradeX offerings have much to recommend them. Although most of the component products were originally developed as on-premises systems, they have been re-architected for deployment on Amazon’s AWS and capture many of the benefits of cloud computing. Furthermore their deep industry functionality goes beyond what many (but not all) cloud ERP providers can offer.

Nevertheless, Infor faces two challenges. First, it must convince a greater share of its 70,000 customers to sign up for UpgradeX. Then, if it does convince them, Infor will need to have the implementation resources trained and available to support those customer migrations.

CloudSuites Are Infor’s Industry-Specific Cloud Solutions

CloudSuite is Infor’s program to deploy its industry-specific solutions to the Amazon cloud. As of this writing, Infor has nine CloudSuite offerings: aerospace and defense, automotive, fashion, food and beverage, healthcare, hospitality, and industrial manufacturing. In addition, there are two broad non-industry-specific CloudSuite offerings: CloudSuite Business for midsize organizations and CloudSuite Corporate for large organizations.

Infor’s CloudSuite offerings are more than hosting or managed services. The products in each CloudSuite have been re-architected as multi-tenant offerings at the application layer, with separate database schemas for each client. (Clients can also choose a single tenant deployment option if preferred, or if needed for regulatory compliance.)

Infor’s Food and Beverage offering is a good example of what goes into a CloudSuite.

- For Food & Beverage, the core ERP solution is Infor M3 (formerly Lawson M3, formerly Intentia). With its strong process industry functionality, built-in warehouse management and factory equipment maintenance capabilities, it’s a good choice for process manufacturing.

- The core CRM can either be M3’s native CRM or Saleslogix, which Infor acquired last year.

- Rounding out the core components are Infor Enterprise Search, Infor BI/Analytics, and Infor Demand Planner.

Food and beverage customers can also choose from a number of optional components, which Infor has integrated by means of its ION middleware.

- Optiva is the industry-specific product lifecycle management (PLM) system.

- There is also an optional M3 warehouse mobility component for factory data collection and support for mobile devices on the plant floor.

- There are also optional Infor components for fresh food planning, document management, and factory planning and scheduling.

As with the other CloudSuites, Infor includes Ming.le™ to provide the social collaboration layer, as well as implementation accelerators, which are pre-configured templates for the food & beverage industry.

UpgradeX is Infor’s Program to Encourage Customers to Upgrade

What, then, is UpgradeX? It is a special offering to existing Infor customers on older versions of its systems, to upgrade those customers to the latest versions of its products deployed on Amazon’s cloud.

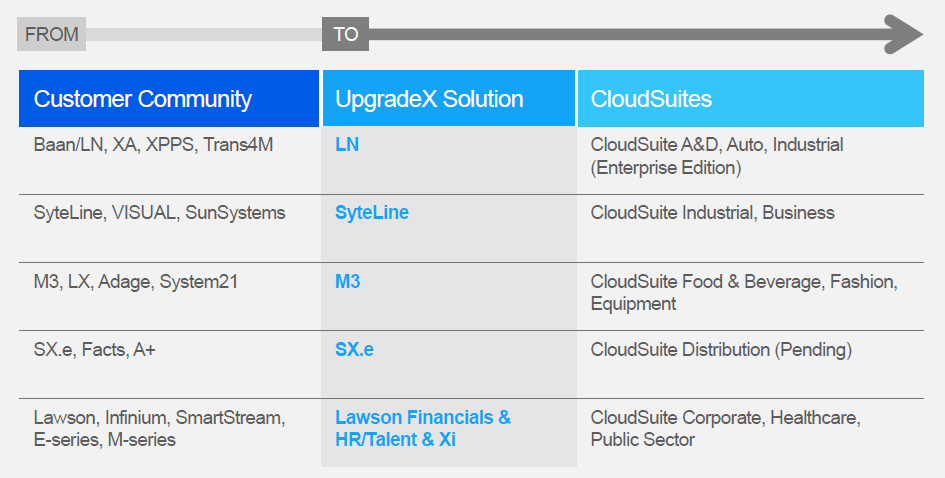

The roadmap from older Infor products to full CloudSuite offerings under UpgradeX is shown on the table below (source: Infor).

UpgradeX includes value engineering to quantify the benefits of upgrading the applications and eliminating modifications, fixed-price implementation services, and ongoing support to keep the customer on current versions going forward. Moreover, Infor is making UpgradeX financially attractive, allowing existing customers take the maintenance fees they are paying for existing systems and exchange them for subscription fees to the new systems.

Last year, we wrote that UpgradeX is Infor’s most urgent initiative. This is because Infor has an enormous installed base of customers, over 70,000, many of whom are on older versions of its acquired products. If Infor does not get them upgraded to current versions, they may eventually leave for other providers. As we wrote last year:

From Infor’s perspective, these are lost opportunities to up-sell and cross-sell additional Infor products to these customers. From the customer’s perspective, there is diminished value from their past investments in Infor products, making them question why they are paying maintenance. This again opens them to abandoning ship for competing products.

Implementation Consultants Are Key

So, the UpgradeX offering is critical. But there are two keys to success:

- The first key is to accelerate adoption. During the briefings, Infor executives gave out one number for the number of CloudSuite customers to date, and afterwards gave a different number. Needless to say, either number is a small percentage of Infor’s installed base. To be fair, CloudSuite is still a new offering, which has only taken shape over the past year or two. So one would expect that, with some determined sales focus, the pace of CloudSuite and UpgradeX go-lives should quicken. Indeed, Infor executives represent that net-new deals, including some really big ones, like Flextronics and Windham Hotels, are increasing. Likewise, we would expect UpgradeX deals to pick up the pace.

- But this leads to a second concern. If a large number of customers buy into UpgradeX, where will the resources come from to deliver those fixed price implementation services? I posed this question to Infor CEO Charles Phillips, who acknowledged that this was a key need. Infor is staffing up its own consulting services, turning over more opportunities to existing partners, and enlisting the help of some global system integration firms, such as Deloitte and HCL.

It’s a tall order. When new enterprise software vendors go to market (e.g., NetSuite, FinancialForce, Kenandy, Rootstock, and other cloud-only providers), their installed base counts are relatively small. Even if they grow rapidly, the number of experienced implementation consultants grows in relationship to the growth in the installed base. Each go-live is an opportunity for more professionals to receive training in the new system.

But in the case of Infor, it acquired 70,000 customers–an enormous number–over a relatively short period. Furthermore, these customers are running a wide variety of Infor systems, some of which can truly be considered legacy systems. When Infor sells an UpgradeX deal, it needs implementation resources who not only know the target systems, but also the legacy systems.

For example, a food processing customer may be running Infor Adage, a system where the installed base has declined to only about 100 customers. But Infor’s core ERP system for food and beverage manufacturers today is Infor M3 (formerly Intentia). So, an Infor Adage customer that signs up for UpgradeX will need implementation resources who understand Adage (the “as-is” system) as well as M3 (the “to be” system).

Over the past decade, the number of experienced implementation consultants for some of these Infor products has dwindled, as demand for them declined. Infor needs to reverse this trend to ensure that the resources are there to deliver UpgradeX services.

Recommendation for Infor Customers

Most of the ERP systems that Infor has acquired are now in better shape. Prior to Infor’s acquisition, many of them were excellent systems, with good industry functionality, but they were languishing after years of under-investment. Even where Infor is sidelining an ERP system such as Adage in favor of another system (M3), at least there is a roadmap to a newer system. Customers of older systems at least have the option to get a return on their maintenance payments over the years.

Infor customers thinking to jump ship should first take a look at what Infor has to offer with its UpgradeX program. The financial incentives could be significant, and even if you need to swap out one Infor system for another, the effort may be less than switching to a whole new provider.

It’s always good for customers to have options.