In the early 2000’s, Microsoft jumped into the business applications market by making acquisitions that brought Great Plains, Solomon, Navision and Axapta into its product portfolio. These products, aimed at small and midsized businesses, established the perception that Microsoft was aiming its business applications primarily at smaller companies. When it came to enterprise applications for global organizations, Microsoft was viewed as out of its league. Those markets were for players such as SAP, Oracle and other vendors with multinational capabilities.

But the market landscape is changing. Over the past year, the Microsoft Business Solutions (MBS) division has been demonstrating that it is capable of delivering two of its business applications—Microsoft Dynamics AX (the descendent of Axapta) and Microsoft Dynamics CRM—to large and multinational organizations. Moreover, Dynamics product enhancements now rolling out will accelerate this trend.

Four Trends

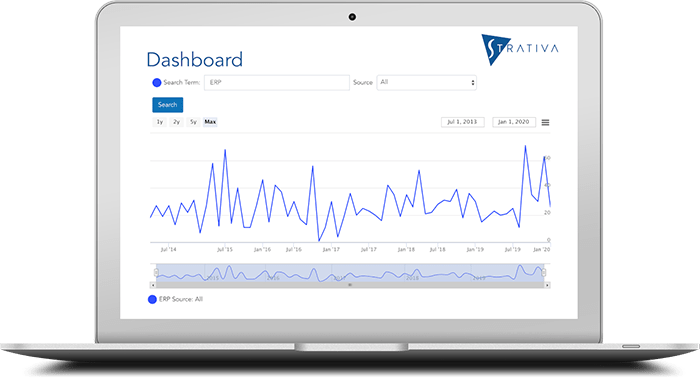

There are at least four market trends that are driving this repositioning, as shown in Figure 1 from a research report, published by our sister IT research firm, Computer Economics:

- Multinational localizations, formerly a requirement only for large companies, are being are increasingly demanded even by small businesses.

- The desire of organizations large and small to manage their people, facilities, and equipment as one global resource pool.

- The continuing pursuit of improved productivity and tighter control, through worldwide business process consistency.

- The need of global organizations to have operating systems that are appropriate to serve the needs of both their large and small operating units.

The MBS division continues to offer software that is aimed at small and midsized businesses (SMBs), those with single-site operations or with limited international presence. Microsoft reseller and systems integrator partners often introduce Dynamics NAV (formerly Navision), Dynamics GP (formerly Great Plains), and Dynamics SL (formerly Solomon) in these situations, sometimes in combination with Microsoft Dynamics CRM for customer relationship management.

Nevertheless, we find that larger enterprises can now consider Microsoft Dynamics when selecting a vendor for their enterprise business applications. In the large company market, it is Dynamics AX (formerly Axapta) along with Dynamics CRM that form the solution offering. Although MBS is seeing success with large organizations in a number of industries, the retail sector appears to be particularly receptive to Microsoft’s move up-market.

Regarding the Full Report

The full report discusses in detail the four customer needs that are driving Microsoft Dynamics up-market and three ways in which Dynamics now has become capable of serving these large organizations. Challenges facing Microsoft in gaining market share among larger companies are also discussed. We conclude with examples of customers that illustrate the move of Dynamics into the enterprise market and recommendations for large enterprise buyers who are considering Microsoft Dynamics.

For more information on the full report, please contact us.